Just in case these thoughts have been running through your head during the recent and ongoing yo-yo-ing markets, here are the most common investment questions we have been asked so far.

1 – How bad are things for my portfolio?

The initial market falls in late February were severe and sharp.

I appreciate that this can be difficult to handle on top of a health crisis, especially as we’re all surrounded by constant noise from the media.

If the stock market plunges, we hear about it in the headlines.

Part of our job is to help your cut through the noise and negativity and, dare I say, “fake news”!

It’s important to remember that a globally diversified portfolio isn’t exposed to the full extremes of stock market downturns.

And did you know the stock market goes up on more days than it does go down?

It’s worth a reminder of what the stock market is;

-Companies

-Managed by brilliant people

-Pursuing rational business objectives

-Measured by the value of earnings, dividends and cash flows

The stock market, therefore, is a collection of the greatest companies in the world.

Our client portfolios contain a blend of these stocks, and also less volatile assets such as government bonds which provide a cushion from the full extent of market falls when they come along.

You, therefore, own a part of the stock market within your portfolio, and how much ‘part’ depends on you, your attitude to risk and your goals.

It’s only right for me to say that because of this cushion, and its size on the way down, you don’t benefit from the full recovery of the stock market over time.

The planning we do for clients is about finding the right balance between downside protection and potential growth.

2 – When are things going to get better?

At the time of writing, the financial markets have partially recovered from their initial falls. Will this recovery be sustained in the coming months?

I would love to assure you it will be, but I can’t.

We can’t predict short term market movements……whether there will be a “second wave” and when a vaccine will be good to go. All these things affect financial markets in the short term.

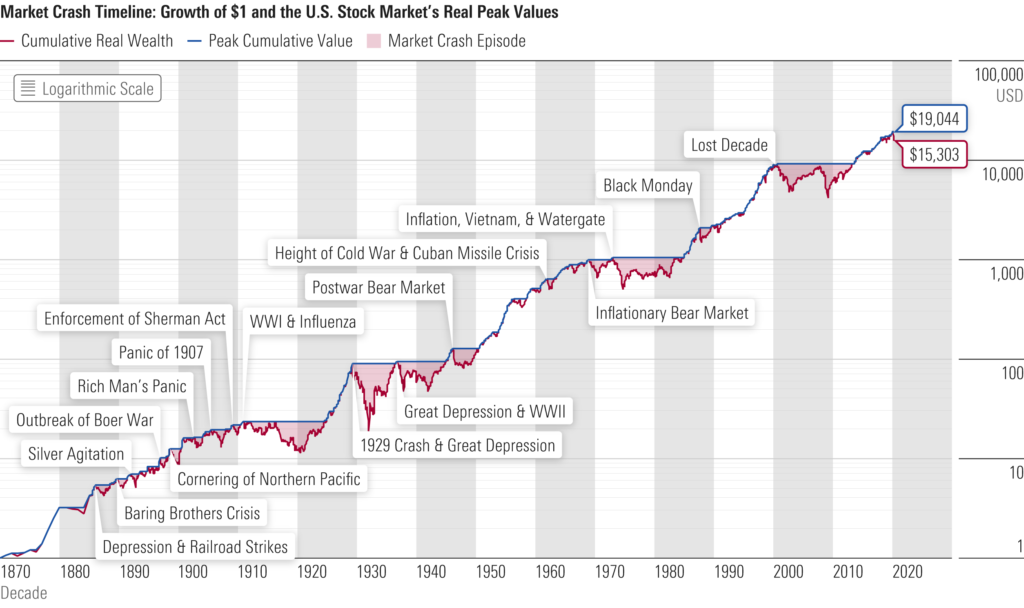

What we do know is that after every stock market fall and financial crisis there’s been over the last 100 + years, in the long term, the markets have recovered and prospered.

This lesson from history is the key; we need to look to the long term; there are no short cuts with investing.

3 – Is selling everything into cash a viable option when markets get scary?

One question we sometimes get asked is whether a portfolio will sell everything down to cash when things get ugly and then buy back when things appear a little calmer. This strategy sounds entirely sensible, in theory.

But, in reality, it’s impossible to do. You would have to get two calls consistently right.

The first call is getting out at the right time – the second is getting back in at the right time.

No green light flashes for the precise time you should do this, unfortunately! And you need to do this every time there’s a sign of trouble in the world…. and crisis never has been and never will be hard to find in the world!

We believe that this is a pretty sure-fire way to destroy your wealth over time, however comforting such a strategy may appear to sound during times such as these.

4 – Is there anything I should do or change?

Our advice to our clients throughout this challenging period has been to:

-tune out the “noise” in the financial press and keep as calm as you can, and have faith in the future.

-remind yourself that sensible investing is a long-term thing, which has been proven to work with patience, discipline and by sticking to a plan

-also, you will have been advised by us to keep a strong cash buffer based on your lifestyle expenditure and our agreed cashflow forecast for times like this when storms need to be weathered

-remember that, as a Thornton client, you have a well-diversified portfolio, with your eggs in hundreds of different baskets – and as I said before, you hold “part” of the stock market in your portfolio.

Please don’t be surprised right now if we tell you “to do nothing”.

At times of crisis, we’re generally wired to want to change things, to react, to make us feel that we are being proactive and “dealing” with the situation.

But unless your personal circumstances have fundamentally changed, keeping calm and doing nothing is almost certain to be our advice right now to you to keep you on the right path.

I hope this has helped. If you’ve got any concerns or questions about anything, we’re here for you – get in touch today.