Sometimes I ask myself this! Especially if it gets to 5 o’clock and I’ve somehow not stopped but not done what I set out to do. That’s not just me, is it!?

A lot of the day is spent problem-solving. Problem-solving for me is where clients have a particular need or objective. I consider the options available, the pros and cons of each, and eventually land at a conclusion. That’s the regulated financial adviser type function.

The other equally important part of my day is spent building financial plans using cash flow modelling techniques. This role is effectively identifying the problems that we then need to go on and solve.

These may be ‘nice’ problems such as getting to age 100 with lots of money left. It might seem odd calling this a problem, but it could be if you’ve got to this point at the expense of not doing the things you really wanted to do when you were younger. They could be ‘not nice’ problems such as running out of money in your mid 70’s, for example.

The thing is that pre-empting these potential problems and planning for them is always an option, but often we bury our heads in the sand instead.

I’m sure we’ve all had situations where we’ve not asked a question because we’ve been afraid to – or afraid to know the answer. Maybe you have been put off making a financial plan before because you don’t know where to start. Maybe you don’t know what information is needed. Maybe you’re scared of the answer.

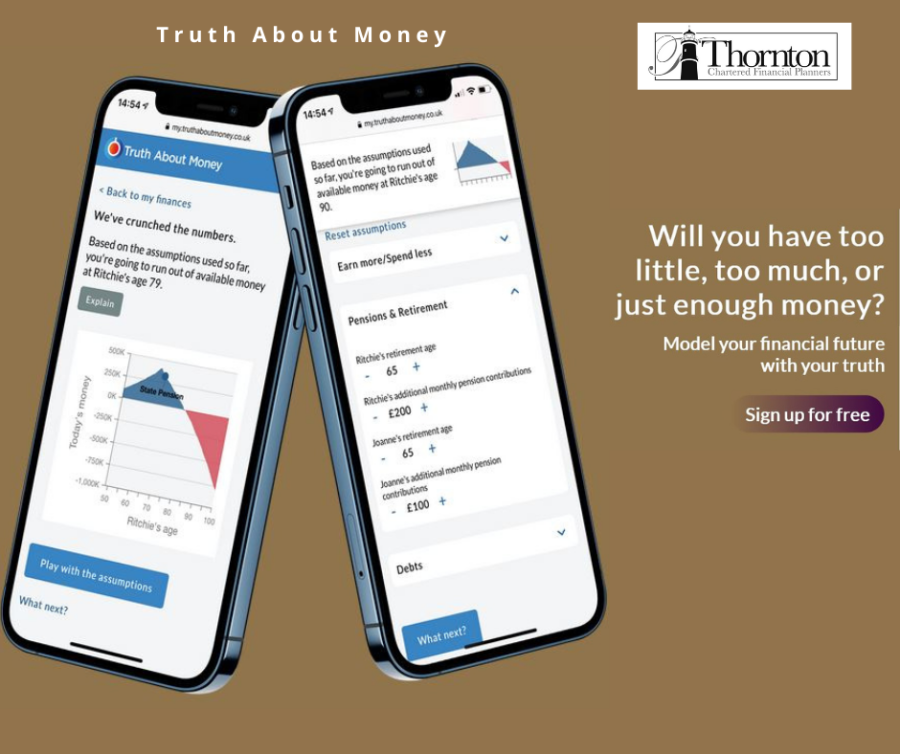

Well, we now have the perfect solution. You can have a go at home! We now have a simplified version of our software available for you to try out.

Truth About Money is now available for you to use. This software allows you to create a basic plan to see if you are on track or way off track!

Why are we doing this?

You might be wondering why we are making this available to clients and for free. Are we mad!?

Well, no, we’re not!

This tool will give you a great idea and overview of your current situation and help you identify if your current plans are realistic or quite the opposite.

What it won’t do is allow you to tailor the assumptions, compare different scenarios, factor in varying levels of income and expenditure at various stages of life.

It won’t challenge your thoughts and ideas or give you a ‘sounding board’.

It also doesn’t replace the 70+ combined years of knowledge and experience of our three Chartered Financial Planners!

It might highlight a few problems; it can’t fix them for you!

Limitations

The system we use with our clients has been tailored for Isle of Man use. Unfortunately, this free version assumes English tax rates.

The absence of Isle of Man tailoring will affect the accuracy of the results.

Still, as all the assumptions are generalised and not specific to each individual, the results will never be spot on. The tax implications are unlikely to change the overall picture fundamentally.

Even with bespoke planning, it is improbable that all assumptions would be correct.

If I ask you what you will spend each year for the rest of your life, do you think you will get it exact?

This fact is why we complete periodic reviews with our clients to adjust their plans along the way, keeping them on track.

You can take the first step towards financial freedom with us by signing up for a free trial of Truth About Money.

We’re here to help make your life simpler and more secure, so don’t wait another second! Sign up today and have the peace of mind that comes from knowing if everything is in order or not.