I often chuckle at the sponsored posts I see on my Facebook feed – turmeric health products, Girl Guiding (honestly!), posture correctors.

I’m not sure what I’m Googling to get these ads, but it’s usually stuff in which I’m not remotely interested.

What I’ve found more worrying is that, over the last two weeks, I’ve been bombarded with adverts for a property investment webinar.

The webinar is seemingly endorsed by a presenter of a reasonably popular property show (although reading the small print, he won’t be attending so maybe knows anything about it!).

Whereas the promotion and provision of financial services and investments are heavily regulated (and rightly so), property investment is not.

It would be wrong to say that property investment is never a good financial move but to claim it’s “the best investment” is misleading, in my opinion.

With the right property and, more importantly, the right tenant in the case of a buy to let, the annual rental income can be an excellent addition to other income sources.

There is also an element of comfort in seeing your capital in the form of a physical building.

Still, some points should be considered before tying your capital up in such an illiquid asset.

Why do people choose property? The big one is the fact you can see it.

Tying up hundreds of thousands of pounds in an investment portfolio for which you are issued with a statement consisting of words and numbers on paper is sometimes hard to comprehend.

Especially when compared to a property that you can not only see; you can potentially go and live in it.

It’s easy to understand. We all grasp the concept of rent and can easily account for that monthly payment as income to spend on our lifestyle.

The concept of dividends and interest within an investment portfolio might be less easy to grasp.

There’s also the varying amounts to consider; look at the dividend cuts following Covid.

Diversification

Most people looking at a buy-to-let property already own their home. Taking your total wealth into account, would you be too heavily invested in property with two or more properties?

We all know the saying “don’t have all your eggs in one basket”. Are you at risk of this with two or more properties?

Having a roof over your head is a necessity. The security that is owning your property provides is invaluable, but what security does a second property add and is the risk/reward balance right?

A typical investment portfolio will have exposure to hundreds of different assets. Portfolios are usually globally diverse and spread over different asset classes with the exact split depending on your personal attitude to risk.

This diversification prevents an overreliance on the performance of a particular geographical area or industry.

Liquidity

Liquidity is a big one with property investing.

Yes, in the last few months it would seem that houses are selling before the estate agents even have time to hammer a for sale sign in the garden. But will that always be the case?

What’s more, property tends to be an all or nothing transaction. You don’t often see individual rooms being sold when cash is needed.

Liquidity provides options.

In an active retirement, we tend to spend more as we have the health, wealth and time to do the things we enjoy. As we slow down, we tend to do less and spend less. Is a regular rental income the right asset to fund this?

In normal market conditions, withdrawing money from investments typically takes ten working days. Investing should be a long-term activity.

Sufficient cash should be retained in the bank to cover immediate capital and expenditure needs.

Proposed Landlord Registration Bill

Bad tenants, empty properties, management fees (if you don’t want to do it yourself), property conveyancing, are all points to consider.

There is also the proposed Landlord Registration (Private Housing) Bill 2020 to consider.

Improving property standards and the safety of private tenants is essential, and most already meet the minimum requirements, but formalising these requirements is undoubtedly another consideration when considering property as an investment.

Registration fees are relatively small, currently expected to be £50 per landlord and £10 per property. But the consequences of forgetting to register are more serious – fines and an inability to charge rent during this period.

Failure to act on an improvement notice carries a maximum 12-month custodial sentence and £50,000 fine.

Landlords must be an Isle of Man resident, or have to appoint a locally based representative – charges are likely to apply.

Records must be kept for 5+ years in line with data protection rules. Rent books must be maintained, appliances PAT (portable appliance test) tested and maintained, manuals kept for supplied appliances and inventories kept.

Legal considerations include the Equality Act 2017 and potential discrimination against those in receipt of Social Security benefits.

How will you evidence a fair and non-discriminatory selection process?

Tax

For a non-IOM resident landlord, all rental income is subject to a 20% income tax.

For IOM residents, rental income is added to other income and taxed at 0%, 10% and 20% accordingly. Certain expenses can be offset against taxable income, but all ‘profits’ are taxable.

A directly held investment portfolio is taxed similarly as there is no capital gains tax on the island, only investment income (dividends and interest) is subject to tax.

Financial Planning and regulated advice

Financial Planning is the process of identifying your lifetime goals and arranging/managing your assets in the best way to meet them.

This process can include a comparison of two scenarios, so property investment versus an investment portfolio, for example.

Having the benefit of a picture of the potential future can help shape decisions.

If property investment is for you, a plan can show the possible optimum time to sell to fund your future lifestyle.

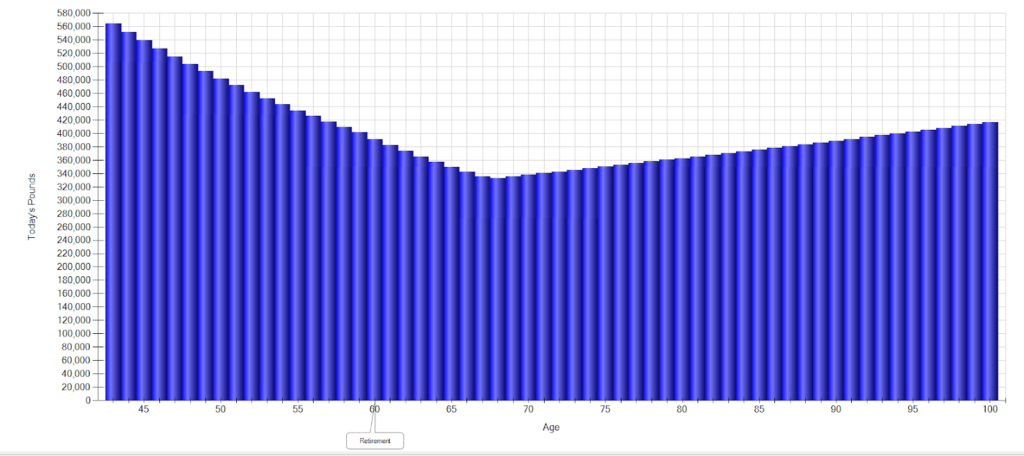

Fig 1. Investment (£150,000 2% growth, 2% income reinvested)

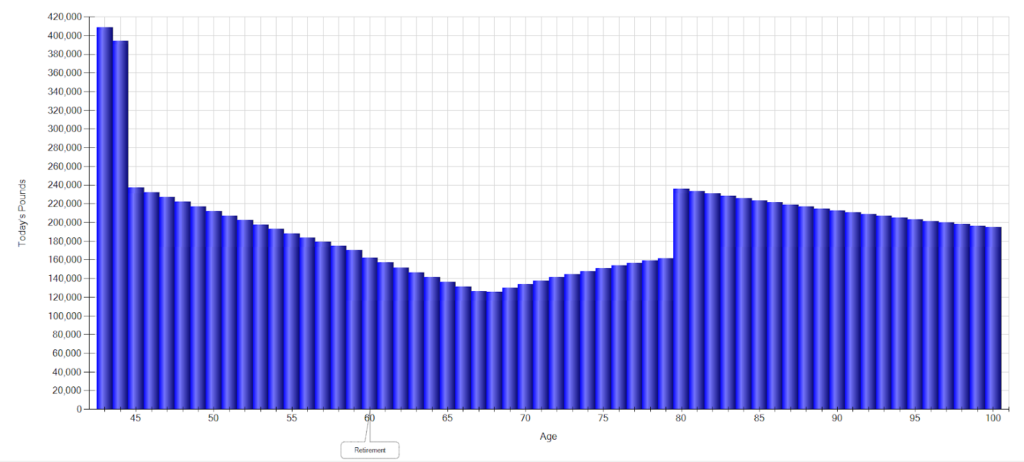

Fig 2. Property (£150,000 – £500 pm rent no periods of vacancy or expenses – sold at age 80)

Regulated investment advice means explaining the pros and cons of any solution in full. Yes, capital is at risk, and values can go down as well as up – we have to make this clear.

More importantly, it’s about making investment decisions that align with your personal objectives and help you achieve what you want. Everyone’s picture of the future and retirement is different, after all.

Without the benefit of hindsight, it’s not possible to know what is the right decision.

It may also be that property interests you and you feel you would gain enjoyment from being a landlord – great if so.

The point is to be aware of all the considerations before buying including the fact that no one in the chain is obliged to tell you either.