As Chartered Financial Planners, we help people to make sensible decisions about their money and how to live their best life possible with it.

This work means helping our clients to avoid making potentially costly mistakes.

In part one of this two-part blog post (part two is coming next Friday), here are five financial mistakes you need to avoid in retirement.

1 – Not falling for “too good to be true” investments.

I’m emailed a ‘not to be missed’ investment opportunity every day.

Today’s unsolicited email offered our clients a guaranteed 10.25% annual return on a Marina development.

Don’t be tempted if you see these. Such schemes can wipe out your wealth overnight.

Unfortunately, lots of people do fall for them.

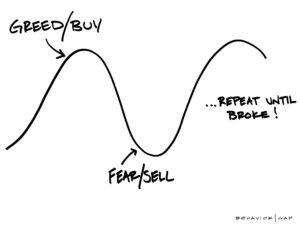

2 – Bailing out of your investment at the wrong time

You will know that investments can go up and down (apart from the “guaranteed” ones mentioned above seemingly)!

The first quarter of 2020 was a stark reminder of this, when the true economic impact of the pandemic began to emerge.

Sharp market falls can be difficult and uncomfortable times for investors. Nobody likes them, but they’re part and parcel of long-term investing.

However, tempting it may be to “bail out”, our advice is more often than not to sit tight.

Buying high and selling low is an expensive mistake.

3 – Trying to “time the market”

The overactive trading of investments, trying to “time the market” and outsmart it, is pretty much impossible.

It’s not just our opinion that it’s a mistake to think you can get this right consistently, it’s also the opinion of the two most high-profile fund managers in the USA (Warren Buffet) and UK (Terry Smith).

Smith runs the largest actively managed investment fund in the UK – the FundSmith Equity Fund. He recently said:

“When it comes to market timing, there are only two sorts of people: those who can’t do it, and those who know they can’t do it”.

4 – Cash deposits, low interest rates and inflation

Holding cash is important. It’s about not having too much or too little.

This is certainly the case during times of stress in the financial markets, such as what we’ve seen during 2020.

Having cash deposits saves having to take money from investments or pensions when values have fallen.

However, carrying too much cash leaves you open to inflation eroding significant “real” value of your savings in retirement.

Think about how much a loaf, stamp, a pint/glass of wine etc. used to be. This memory should bring inflation risk sharply into focus in the real world.

5 – Spending too much money

No one wants to run out of money. We calculate safe lifetime withdrawal rates to ensure that people don’t run the risk of running their retirement pots dry.

Taking withdrawals of 6-7% + p.a. is potentially asking for trouble down the line.

Do any of these financial mistakes to avoid in retirement resonate with you?

Here at Thornton, we exist to inspire you, give you confidence and the freedom to live the best possible life with your money.

If that sounds like a worthwhile outcome, please get in touch – we would love to hear from you.